Accounting firms continue to move critical business applications to the cloud

Accounting firms continue to move critical business applications to the cloud and off of in-house servers, the 2022 CPAFMA Digital Survey revealed.

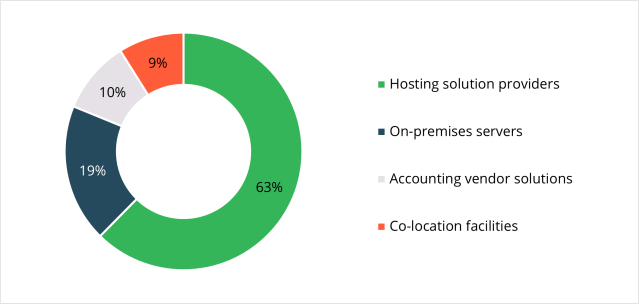

The move to the cloud has become a trend in recent years, driven largely by firms looking to reduce downtime and bulk up security. Fewer than 20% of respondents said they still host applications on internal servers, with more than 60% having already moved to a cloud hosting platform.

Where do accounting firms host their applications?

Increasing security while reducing downtime

The choice of cloud provider matters, though. Cloud outages actually ranked as the second most common cause of system outages at firms, although in most cases firms that experienced outages were relying on application vendors or small hosting providers for cloud access. Established, reliable cloud providers such as Right Networks enable firms to avoid downtime more effectively than other methods of running applications can.

Four major causes of downtime in accounting firms (and how to deal with them):

- Internet outages, which firms can avoid by setting up redundant Internet connections and dual broadband routers with automatic failover.

- Cloud outages, mostly caused by smaller, unreliable cloud hosting providers and application vendors experiencing outages at their own businesses, cause downtime for firms.

- Hardware failures, primarily caused by on-premises servers, are easily avoided when firms move applications to a highly reliable cloud provider.

- Local power outages or disasters can make working in the office impossible. Cloud providers have built-in power and internet redundancy so as long as your people can get to a location with both of these they can continue to work.

Aside from downtime reduction, security is another major reason accounting firms continue to move to the cloud. The survey showed that firms are moving away from consumer-grade anti-virus and security applications and toward enterprise-class solutions. That move is happening in large part because firms are running applications with reliable cloud providers, which offer the same high level of security large financial institutions enjoy.

Other trends: Bigger screens, QuickBooks, CAAS, firm administration

The CPAFMA survey identified some other major trends, including a noticeable increase in the number of firms transitioning to laptops as their only machine and in particular an increase in firms selecting larger 17” laptops.

In tax production, there was minimal movement of firms from their existing tax application unless they were acquired by a firm mandating they move to their different solution. Many firms stated, however, that doing tax projections with their existing tax application was effective as there was a reduction in firms using the dedicated BNA tax planner that was dominant in the past.

Digital ingress of documents in firms increased significantly in the previous two years due to COVID, and cPaperless products (SafeSend/SafeSign) made significant inroads. RightSignature, DocuSign, Adobe, and CCH AssureSign for eSignature applications picked up users as well. CCH Workflow (formerly XCM), Thomson FirmFlow, CCH Workstream, and Doc.It workflow tools all saw increased adoption, proving their effectiveness in improving firm productivity, particularly for firms adopting hybrid work as their standard.

In the assurance and client accounting and advisory service (CAAS) space, analysis of the data suggested that there will not likely be much change in firm audit binder or A&A guidance applications for the next two years as the licensing agreements have not provided a reason to switch. However, at the end of 2023 or 2024, there could emerge a leader providing an integrated audit solution in the cloud that could also be utilized by firms for their tax binder.

Firms should be careful evaluating anything promising “artificial intelligence” and instead focus on “augmented intelligence” tools that enable accountants to script or codify their knowledge and recommendations. Firms should formally evaluate applications that could be integrated to create a business information platform or CAAS “tech stack.” The survey noted that only 20% of respondents knew the components of their business tech stack, which firms should be building today.

In accounting firm administration, for internal firm management and applications, the majority of CPA firms continue to use Intuit QuickBooks (online and desktop). Other popular applications include Sage Intacct and Microsoft Dynamics for firms’ internal accounting. However, for payroll processing, the number of firms using Intuit dropped, with more firms going to the dedicated payroll solutions integrated into human resources information systems.

Many firms continued to use SharePoint and WordPress for their firm intranets, but there was a slight trend toward firms adopting Microsoft Teams, which shows the versatility of Teams beyond collaboration. While there was no significant change in the use of practice management applications, there was noticeable adoption of integrated web payment solutions, such as Thomson Reuters firms adopting CPA Charge and CCH firms starting to adopt QuickFee.

Looking to the digital future for accounting firms

Technologies such as crypto and digital finance could impact the accounting profession, and the emergence of “Finance as a Service” could begin to disintermediate accounting services for firms that do not pursue a client advisory approach. It is imperative that firms build a business “tech stack” to deliver actionable results to clients of the firm.