Every year, CPA Practice Advisor brings together 30 or so accounting thought leaders to discuss the world of accounting and the topics that matter for the year ahead. It’s a chance to discuss and identify accounting technology trends.

This year—my thirteenth as part of the group—I contributed to discussions about accounting firm production automation, stable and emerging technology utilization, and accounting firm information security, since those are the topics I focus upon in my direct consulting with firms.

While it had been a few years since our last in-person gathering, everyone quickly jumped into the event.

Accounting technology trends (and more) to watch now

Here is a recap of what we discussed and the trends in accounting, technology and other areas firms should be aware of for the next 12 months:

Successful tax advisory model

With this year’s tax season already underway, the first major discussion revolved around firms that are succeeding in the tax advisory space. Tax planning was one of the most common first forays into advisory services. Firms already had relationships with clients and access to their documents. Also, they most likely knew which clients would benefit most from conducting a tax projection/advisory engagement.

Most firms today use standard projection software within their tax applications for tax planning. With projection applications, firms can do “what-if” analysis. That allows them to minimize existing taxes and plan out estimated payments, which are dependent on the knowledge of the tax preparer.

Tax-planning app vendor Corvee took a different tack with its accounting technology and integrated 1,500 tax minimization strategies. The accountant can assist a client in implementing those strategies over multiple years. The result was significantly larger tax deductions for the client and therefore higher advisory revenue to the firm.

Corvee not only assisted firms with using the software but also with adopting a value billing model that allowed the accountant to participate in those savings. Again, this increased margins and provided a path for firms to deliver a comprehensive tax advisory service to their clients.

ChatGPT AI

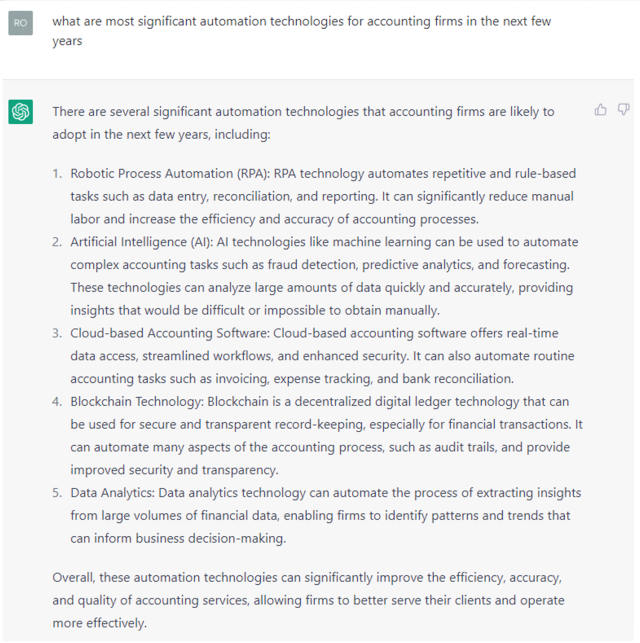

The second major topic discussed was the recent popularity of OpenAI’s ChatGPT artificial intelligence platform. ChatGPT utilizes a natural language interface to provide summarized content. Thought leaders pointed out that while this was not a new technology, it had grown quickly due to its simplicity to use and uncanny human-like responses.

Becky Livingston, founder and CEO of Penheel Marketing, presented a comprehensive overview of how firms could use chatbots for getting summary analysis and generating marketing content. She said that while ChatGPT was very good at responding to broad questions where information is somewhat static, it is not currently good at numerical calculations. Also, its knowledge was capped with data learned by the system prior to 2022. Therefore, users should not rely on it without comprehensive fact checking.

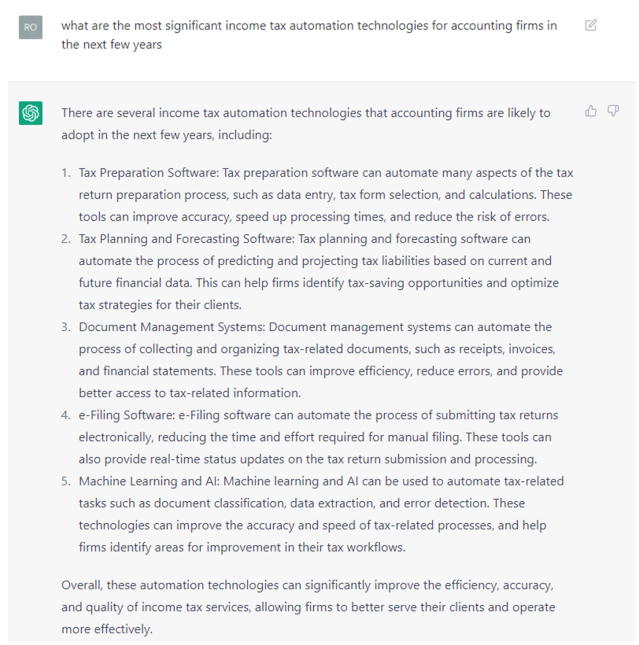

The application is currently free based on availability. To provide a broad example of how it works, I asked the following question and received the following response:

This information was generated only by the prompt question and is surprisingly comprehensive. Then again, these are topics that many thought leaders have written about in the past few years. I then asked the same question but added “income tax,” and the answer became more targeted and surprisingly comprehensive:

I honestly would have a hard time disagreeing with anything in these AI-generated responses, except that I would have added workflow/ERP accounting technology to the income tax inquiry. This points out what OpenAI itself notes: the chatbot generates responses based on the information it was trained upon. Users should fact-check and verify everything the chatbot produces. New information may have come to light.

Users can request citations for information or statistics. However, the group pointed out that this could easily include incorrect and often completely wrong information. For example, when I asked ChatGPT to “tell me about Roman Kepczyk,” most of the information was summarized from various biographies on the Internet. But it somehow stated that I graduated for Marquette University rather than my actual alma mater, Arizona State University.

Anyway, I feel these chatbots are just one way that practical artificial intelligence will make it into our firm. I summarized this in a more comprehensive article for CPA Practice Advisor.

DEI (diversity, equity, inclusion)

Most observers in the profession expect staffing shortages to get even worse in the next few years. The group pointed out that having a more diverse population to hire from resulted in a broader range of experiences and knowledge. That, in turn, helps differentiate firms and enables them recruit employees.

The group discussed how DEI initiatives have seemed to stall recently. Participants felt that re-invigorating discussions could only help the accounting profession attract the best and brightest. And that firm leadership needed to be sincerely “bought in” to DEI initiatives. They also observed that being transparent and reporting on initiatives was critical.

Some of the current DEI initiatives in organizations pointed to the creations of employee resource groups where people could be “with others like them.” However, what I pulled from the thought leaders instead was that creating a firm environment that “accepted everyone for who they were” was a better path. Firms would accomplish that when everyone in the firm “felt they belonged” just as they were.

Higher education and accounting

Another discussion centered around the issue that accounting as a major has become even less attractive to students. Part of this is likely due to a pay disparity when compared to other majors. But many thought leaders found that students were not well prepared for the real world of working in an accounting practice. They said that it took many months to get them to be productive in a firm.

This seemed to create a negative first impression for students who queried recent graduates newly working in firms. Thought leaders suggested that rather than just teaching to pass the CPA exam, the learning curriculum in universities needed to expand to more of a residency model. Students would have a more practical, internship-like experience in their fifth year.

They also suggested looking into programs designed to onboard mid-career students on a fast track, including rewarding external experience with credits and using community colleges for teaching students the basics.

Interestingly, the group discussed when each thought leader became interested in accounting. A surprising number of participants pointed to their high school experiences. We felt the pipeline could be boosted if the AICPA can get accounting incorporated into the high school STEM (science, technology, engineering and math) curriculum, where there is additional funding and resources.

Data security

Not surprisingly, information security was another prime topic for the thought leaders. Most felt that bad actors were becoming increasingly sophisticated and difficult to defend against. Our belief is that all organizations need professional/enterprise-grade security teams in place. By default, that means outsourcing to enterprise-level providers that have dedicated teams focused on security.

These teams need to be familiar with the unique aspects of accounting technology. This requires constantly maintaining significantly more applications in a broader range of locations. That includes incorporating remote workers and clients who want to work digitally with the firm. In addition to outsourcing the monitoring, detection and remediation of cyberthreats, it is mission critical that firms have a comprehensive and ongoing training program to educate and test employees on the latest threats.

Suite vs. best-of-breed accounting technology solutions

One of the final topics debated was the current suite vs. best-of-breed options in accounting technology. The group discussed Microsoft Office as a prime example of a working suite of applications. This is defined as having integration between applications and common menus/training between tools. However, most of the thought leaders did not see accounting vendors delivering comprehensive, working suites to firms.

In general, participants felt that most accounting firms were picking best-of-breed applications to solve their particular needs. We have seen this in the explosion of standalone tax, assurance and, in particular, CAAS (client accounting and advisory services) applications that firms are adopting today.

Want to read more recaps from recent events? Check out my recent blog from CPA Consultants’ Alliance.