Bracing For The Tax Season 2022 Extension

After facing the unparalleled trials of tax season 2022, the upcoming tax extension season may cause apprehension for your staff. Your team needs a tax season debriefing! Below are a few tips on making your tax season debrief session a success.

Why Host a Tax Season 2022 Debrief Now

Why would you want to offer a tax debrief a few months before the tax season 2022 extension?

Well, why wouldn’t you?

The details of what happened during the April 18th frenzy would be fresh in everyone’s minds.

CPAs and accountants may also be eager to discuss the pluses and minuses of the tax season and see what they can learn from it. Lessons gained could enhance fall extension procedures, enabling teams to perform more efficiently despite previous hiccups.

Other great reasons to schedule an end of year tax season debrief meeting include:

- Uplift your team: A tax season debrief would be the optimum time to recognize your team’s efforts. You can also strategize a bit for the upcoming extension of tax season 2022.

- Improve workflow: The summer lull is the right time to investigate and purchase the latest cloud-based accounting software. Be sure to make clients aware that you’re implementing such changes, which may increase confidence in your firm.

- Educational experiences: The atmosphere of a tax season 2022 debrief offers an opportunity for professional development and growth. Take that time and train new employees on handling the forthcoming October 15th deadline that marks the end of tax season 2022.

- Do your homework: Take the tax extension season to examine what your firm’s successes were so you could replicate them. On the flipside, honestly identify areas in need of improvement, which is the main reason for conducting the debrief meeting.

Tax Season 2022 Debrief Best Practices

As the Director of Firm Technology and Strategy for Right Networks, I advise you to catch information while it is fresh in everybody’s minds. This means scheduling your tax season debriefing a week or two after the busy season deadline.

A debriefing would also be an optimum time to survey all your firm members to see how COVID-19 impacted them during tax season 2022.

You may also want to:

- Identify any bottlenecks in your firm’s pipeline and find specific solutions that address these problems.

- Survey the staff regarding the busy season in preparation for the fall extension and consider getting client input during the survey process as well.

- Look for numerous other ways to improve your firm’s communication efforts, internally and externally, to provide optimum customer service.

- Modernize your firm; I mean, why file a paper return when you can do so electronically? It is much faster, more secure, and reduces waste.

- You may find several opportunities to improve before the tax extension deadline by actively engaging with your team and getting customer input.

- Try to open the discussion; get everyone involved and on board to implement innovative ideas and concepts.

For instance, you might want to explore ways to make your environment digital, especially in the post-COVID-19 era, where hybrid work environments are fast becoming mainstream.

This type of consideration could help any tax professional address pandemic-related or any other needs should another catastrophe strike.

By implementing these strategies, you and your team can be better prepared for whatever comes your way!

Main Topics to Discuss With Tax Professionals

Whether you decide to hold an in-person or virtual tax season debrief with your team, a few topics will be of note.

Tax season 2022 was exhausting, and your team may very well have a few ideas they want to discuss on how to prepare for the future. For this reason, you may want to sit down and discuss a few of the issues that cropped up and how to address them.

Some common themes may include:

- Workflow issues: COVID-19 introduced a near truckload of new codes and regulations to deal with the monumental economic crisis. If your work pipeline is antiquated and primarily manual, this could have led to a backlog and increased confusion. During the tax season 2022 debriefing, try to discover what frustrated your team and find workable solutions.

- Miscommunication: Now, this can fall on the heels of workflow issues. If your firm lacks efficiency, it will make communication between departments impossible. The upside to tax season 2022 is that it did manage to highlight the weak spots in need of fixing. If you address these concerns, you will be better able to assist your team in delivering quality customer service in the future.

- Identify and eliminate waste: Another thing that could hamper productivity is procedural or organizational excess that can be reduced. Capturing data digitally, collaborating virtually, and building quality control into each step of the tax production process.

Another Viable Tax Season 2022 Steps

Put a time-saving plan into motion. Cut down on the useless clutter with efficient, time-saving enhancements to the office pipeline. Talking to your team and getting their input is the best method of producing feasible solutions that make everyone’s jobs faster and easier.

Create an in-depth survey to gauge perceptions. Your group will most definitely have ideas about how to proceed after another post-COVID-19 tax season.

Ask them if they felt this was a better or worse busy season and why? Provide open-ended questions that range from completely agree to disagree completely. Make the questionnaire simple, anonymous, and something beneficial to the collective. The same can be done for your clients, which will increase your customer service acumen.

Learn More About Hosting Your Tax Season 2022 Debrief

There are many reasons why you would want to host a tax season debriefing for your team.

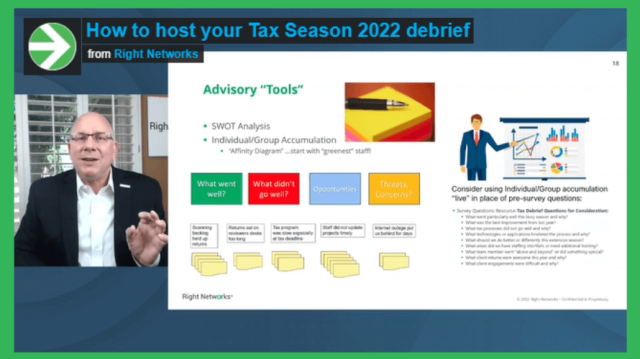

If you want to learn more, check out my webinar, How to host your tax season 2022 debrief, for further tips. You can also reach our offices for details about making future tax seasons easier with cloud hosting technology at rightnetworks.com/get-started/.