The New Horizon Group (NHG) think tank met at AICPA’s Washington office on April 9-10, 2024. The group collaborated on key issues impacting the accounting profession. We also discussed challenges and opportunities from the viewpoint of each of our unique advisory disciplines.

NHG has been meeting annually for more than two decades and consists of leading senior consultants to the accounting profession. Several topics emerged as being particularly timely and relevant. These topics included positioning for mergers and acquisitions (M&A), artificial intelligence (AI) and the initiatives that the AICPA was focusing on this year. One of those initiatives in particular is addressing the accounting pipeline shortage with the National Pipeline Advisory Group.

New Horizon Group takes on M&A positioning

New Horizon Group members revealed that only about one-third of mergers or acquisitions that involved private equity came to fruition. However, this activity actually prompted the other two-thirds to consider making positive changes in their own firms. Half of that group followed through, implementing various levels of improvement. The other half paid lip service and will probably pursue another M&A opportunity within the next three to four years.

Private equity has definitely changed the game on these deals. M&A consigliere Allan Koltin shared six indicators that differentiated the value of a firm to an acquiring entity:

- Consistent strong organic growth from the firm’s existing client base.

- Sustainable profitability—the firm understands it is a business and makes a good profit.

- Investing in the future with technology, training and more than competitive salaries.

- Building a great bench: The next generation of leaders, business builders, deliverers and technical people.

- Happy people—the firm proactively focuses on a great culture.

- Happy clients—the firm consistently delivers great service and responsiveness.

How the accounting profession can use AI

Along with Jim Bourke, managing director of advisory services at Withum, I led a discussion on AI. The phrase artificial intelligence means different things to different people. The “A” can stand for artificial, automated or augmented.

We started out by stating that accountants will not be replaced by AI but by accountants using AI. At their core, AI tools today are simply more advanced computer applications that we can use to do our jobs more effectively. While most of the AI hype today is around generative AI tools such as ChatGPT, there are many firms already using application program interfaces (APIs), machine learning and robotic process automation (RPA) tools.

Those tools are very effective at automating information processes. That’s particularly true when an accountant uses them to handle initial analysis, identifying errors and handling anomalies (especially in the CAAS space). We see firms getting over initial generative AI fears once peers successfully use it and major vendors provide vetted solutions and training.

We believe that Microsoft’s Copilot will be the most rapidly adopted generative AI tool within firms. This will happen first via Bing Copilot (formerly chat) and then through Microsoft 365 Copilot integration with Excel, Outlook, Teams, etc. This will be followed by accounting application vendor solutions that incorporate narrow AI capabilities for specific accounting functions. Before we know it, AI will be another tool to make accountants more effective. PCs, spreadsheets, the Internet and the cloud all went through the same cycle.

AICPA reveals its areas of focus for 2024

Lisa Simpson, Vice President of Firm Services at the AICPA, shared key initiatives that the AICPA is focusing on this year.

‘Transforming Your Business Model’ project

One is the Private Companies Practice Section’s (PCPS) Transforming Your Business Model project. This program aims to help firms become an “employer of choice” by creating a culture that attracts, develops and retains accounting professionals.

Strategic planning toolkit

The AICPA has already developed toolkits and resources for strategic planning, right-sizing your client base, modeling revenue and employee compensation, and building a non-CPA workstream. These resources are available to members of the PCPS, of which I have been a member for many years. Lisa shared that AICPA Town Halls continue to be a very effective and popular communication channel for members. These broadcasts (on Thursdays at 3 p.m. ET) come with one hour of CPE (free for AICPA members) and can be replayed on demand. This makes them ideal for team lunch-and-learn meetings.

Dynamic Audit Solution

Lisa next shared that Dynamic Audit Solution (DAS) launched commercially in the summer of 2023. The earliest cohort of firms has been using the solution in their practices. Rollout to a broader cohort of firms is also underway, beginning with the change management preparation and planning that ensures successful adoption. For firms not familiar with DAS, it is a comprehensive, end-to-end, cloud-based solution from the AICPA, CPA.com and Caseware.

DAS is powered by transformative methodology developed by the AICPA, in partnership with leading firms and audit practitioners, and built on the Caseware Cloud platform. It enhances the efficiency, quality and client value of financial statement audits through a risk-focused, data-driven approach. DAS is unique in that it has been designed with a truly open architecture. This allows third parties to integrate auditing tools and components for more effective assurance.

Startup Accelerator

The AICPA, along with CPA.com, the business and technology subsidiary of the AICPA, also supports the growth of early-stage technology companies benefiting the accounting and finance ecosystem through the Startup Accelerator program. The 2024 cohort is focused on companies leveraging AI aimed at creating efficiencies and enhancing value in services across audit, accounting, tax advisory and firm management. To further communication in the assurance space, Lisa also shared that the AICPA has launched a monthly A&A broadcast.

National Pipeline Advisory Group recruits students for accounting

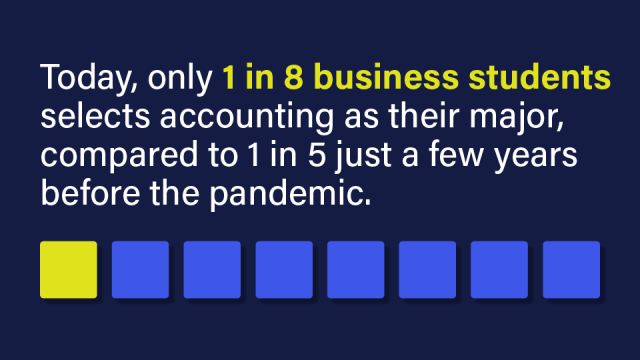

Today, only 1 in 8 business students select accounting as their major, according to Wiley Publishing. The declining accountant pipeline has been setting off alarms across the profession. Dozens of surveys have launched with the goal of figuring out why and how the profession can respond.

To bring together those efforts, the AICPA Council resolved to form an independent cross-industry group of 22 finance and accounting leaders, CPA firm partners, academics, state society directors, regulators and consultants to independently explore the pipeline issue and potential solutions. Jennifer Wilson of Convergence Coaching is the independent facilitator coordinating the effort.

About half of today’s accounting students selected the profession before going to college because they were influenced by a role model or took a high school accounting class. These influences have begun to wane, particularly since candidates have heard negative stories about overwhelming work volumes or lower starting salaries compared to peers. (While accountants have lower initial salaries, they catch up or pass most other business major peers in salary and prestige by mid-career.)

How the profession can build interest in accounting

So, what can we do to promote interest in accounting? First, accountants can tell a more compelling story about the broad range of opportunities that the profession can provide. We can share personal positive stories and client experiences, as well as the true earning potential.

Second, educational organizations can make introductory accounting courses more interesting and representative of the broad range of cool work experiences. Next, since the cost of additional coursework and the effort to take the CPA exam seems to be an additional burden specific to accounting candidates, firms can show support by providing time for students to study and take the exam, as well as by providing financial support to promote those efforts.

Finally, paying more competitive starting salaries compared with other professions, investing in a more inclusive, diverse culture, and transitioning to more manageable workloads will undoubtedly promote a more positive experience. One way you can help today is by providing your input to solution ideas by completing the national survey.

For more updates on accounting and accountants, subscribe to the Rightworks blog below.