Majority of small businesses plan to pocket their tax savings

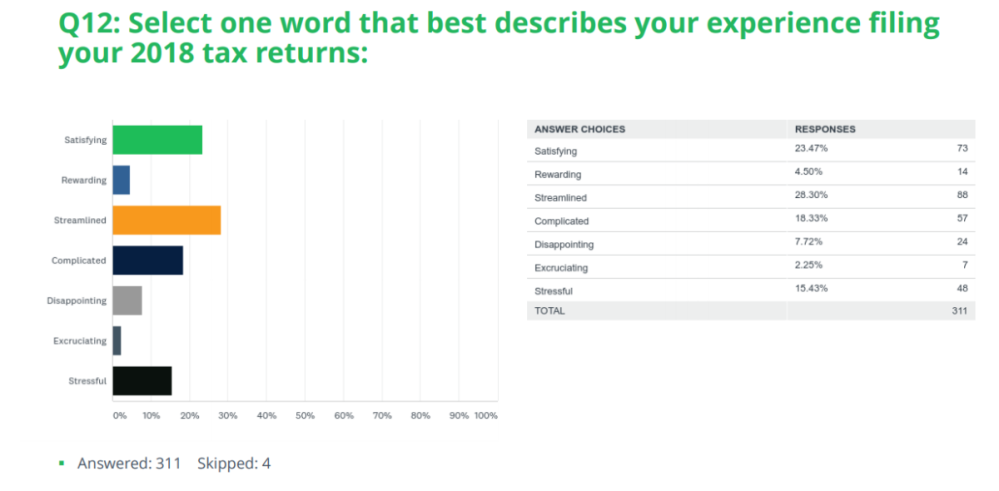

HUDSON, N.H.–(BUSINESS WIRE)–In contrast to fears of a stressful and complicated tax season due to tax reforms, a 2019 Post-Tax Season survey of 300+ small businesses from cloud-based accounting solution provider Right Networks found overall attitudes towards their 2018 tax filing as overwhelmingly positive, with only 15% describing the process as “stressful.” In fact, when asked to select one word that best describes their experience filing their 2018 tax returns, the top two words chosen were “streamlined” and “satisfying:”

| Streamlined | 28% | |||

| Satisfying | 23% | |||

| Complicated | 18% | |||

| Stressful | 15% | |||

| Disappointing | 8% | |||

| Rewarding | 5% | |||

| Excruciating | 2% | |||

Most small businesses will be putting tax savings in their back pockets

Saving and investing in inventory or capital goods are the top two actions small businesses said they plan to take with their tax savings, with hiring more people coming in a distant third.

“Despite a strong economy, plenty of small business owners still harbor memories of the Great Recession, which may explain their desire to pocket their savings,” said Joel Hughes, CEO of Right Networks. “As for the lack of hiring, with unemployment at a 50-year low, most businesses simply can’t find people to hire, making investing in capital expenses a smart choice to take their business to the next level,” said Joel Hughes, CEO of Right Networks.

Republican party seen as more favorable to small business success

Optimism is high that the savings will continue, as 80% of small businesses expect the tax reforms to remain in place for at least the next three years. As for the political party viewed as most favorable to the success of their small business, 46% of respondents said the Republican party, 38% said they do not know, and 6% said the Democratic party.

CPAs successful in guiding small businesses through tax changes

Not surprisingly, owing more money than expected was the top concern of more than half (55%) of the respondents, followed by concerns that their accountant would not be knowledgeable about the tax changes (23%), and a lack of resources to handle the filing due to tax changes (16%).

These fears, however, were largely unfounded, as 54% of respondents were very satisfied and 43% were satisfied with their CPA’s knowledge of the new tax rules. In addition, 68% reported that their CPA anticipated the impact of tax changes on their business and guided them on how to take advantage.

“Small businesses we surveyed gave their CPA a resounding thumbs up when it came to guiding them through the 2018 tax reforms,” said Hughes. “This was gratifying to see, as at Right Networks our mission is to help ease stress during tax time by enabling frictionless collaboration with their CPAs and eliminating worries around IT and data loss. In a year when strong collaboration was essential, CPAs adeptly navigated the reforms and helped their small business clients reap the benefits.”

In terms of how their CPA could serve them better when it comes to taxes, respondents said:

| Share more information and best practices | 39% | ||

| Be more proactive in educating me on changes and the impact to my business | 35% | ||

| Call me more often, checking in at least once per quarter | 13% | ||

Methodology

This nationally representative survey was conducted online among 29,599 Right Networks small business customers and prospects and fielded between April 24 through May 1, 2019. The survey yielded responses from 315 small businesses. The margin of error was +/-5%.