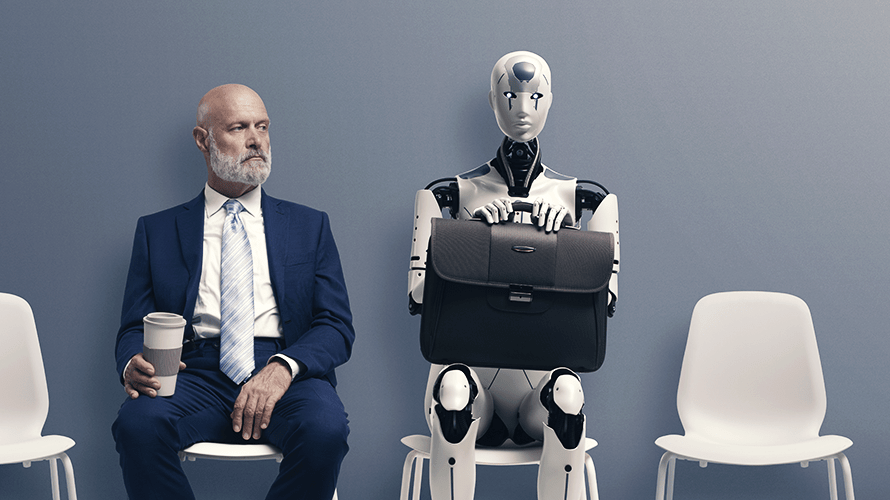

Should accountants freak out about artificial intelligence in accounting? At first blush, the answer seems to be yes. ChatGPT, the now famous artificial intelligence (AI) chatbot, along with other competitive chatbots, is already replacing human beings in a wide variety of roles. Generally, ChatGPT has led to cost savings and general satisfaction among the companies that have adopted it…and in the process, kicked people to the curb.

A quick glance at the fields in which ChatGPT and other AI tools are best poised to make humans obsolete does indeed show that accountants are at risk—along with just about everybody else, including such established professionals as coders, stock traders, teachers and content writers. So, is it time to shut down the firm and head for a cabin in the woods? Not necessarily.

ChatGPT in particular and AI in general aren’t ready to replace accountants yet and might never be. In fact, accountants who use AI wisely can get a jump on those who don’t—and put the technology to work to improve their firms.

What artificial intelligence in accounting can do for you

Let’s start with the good news for once. AI can help you run your firm more efficiently. There are different definitions and categories of AI. Fundamentally, AI applications are those that can crawl massive amounts of information, “learn” that information, and then present it in some organized and approachable format upon request. That’s what ChatGPT does.

Some of the technology you already or will soon use in your firm might not be AI in the strictest sense. It may fall into the category of automation or augmented technology. Nonetheless, it can help you, and so can applications that meet a narrower definition of AI. Here are some ways you can use a somewhat narrow definition of AI to improve your firm’s operation:

1. Marketing and website content

If you’re not a writer, and your firm doesn’t employ a content writer, AI—and ChatGPT in particular—can help. It might not give you a particularly polished product, but ChatGPT can organize ideas for you. It can also deliver content in a clean format that you can tweak to create content that promotes your firm.

You’ll need to check the accuracy of the output. However, if you’re the kind of person who stares for ages at a blank document on your computer, ChatGPT can get you started. The same goes for creating content for your website or for social media. Content creation is a fairly simple way to incorporate AI into your firm.

AI can do more, though.

2. Predictive cybersecurity

One of the primary weaknesses of many cybersecurity protections is that they often can’t see threats coming. They can recognize and neutralize threats as soon as they occur, which is critical in preventing damage from data breaches. But AI takes your cyber defenses to a new level by detecting security irregularities, predicting potential future data leaks and responding in real time to data breaches.

Of course, the technology capable of predicting a breach is still evolving, as is all AI technology. The good news is that when AI enhances security, it doesn’t threaten any jobs in your firm because it’s taking on a task you’re better off outsourcing, anyway. The marriage of AI and cybersecurity is strictly a benefit for firms.

3. Financial reporting for forecasting

Another AI breakthrough for both firms and clients involves financial reporting for forecasting. AI can provide you with real-time insights into how your firm is performing and how clients’ businesses are doing as well. With real-time rather than retroactive insight, and with AI’s ability to pick up on and predict trends, you’ll be able to forecast metrics for your firm and your clients more accurately than ever before.

This represents a major opportunity to move your firm away from relying heavily on tax return processing and focus instead on a year-round business model. When you spread your work and revenue over the course of the whole year, you build relationships with clients, create a healthier culture for employees and ultimately improve your own quality of life. AI can help move you toward all of that.

The drawbacks of artificial intelligence in accounting

Like most emerging technologies, AI is imperfect. That’s especially true for ChatGPT, the bot that has received so much attention and caused so much trepidation among workers. Yes, it’s amazing that ChatGPT can produce an essay about almost anything that’s passable as a college paper or even a news story. But there’s one problem: ChatGPT gets stuff wrong.

Any AI bot is only as reliable as the information it draws from, and—surprise!—not everything ChatGPT crawls online is verifiable or even accurate. In fact, the chatbot is fairly susceptible to inaccuracies that aren’t necessarily obvious at first glance. A long, impressive-looking essay can still contain a few incorrect bits of information, which means a human really needs to check everything ChatGPT produces.

The intent here isn’t to dump on ChatGPT. It’s just to remind you that AI isn’t ready to break away from humanity yet and might never be. The same goes for other AI applications. Some will be built into systems you’ll likely never touch, like a cloud-based security service that uses AI to seek out potential data breaches. But you’ll have to keep a close watch on the ones you do use directly.

The fallibility of AI plays into the reason why it’s unlikely to eliminate accounting jobs. AI doesn’t have expertise in accounting. It has the ability to soak up and spit out information, very quickly and sometimes impressively. But it doesn’t know what it’s doing. You do. And it’s not sentient. You are.

Your clients will want a person behind the wheel even if the car is self-driving—and, at this point, it isn’t. AI is a tool, not your enemy. But if AI lets you hire fewer employees in an extremely tight job market for accountants, that might be a positive byproduct of the technology.

How to deal with artificial intelligence in accounting

If you haven’t already, now is the time to automate manual tasks in your firm. AI and automation tools can help. And if you haven’t yet, you absolutely need to move your firm toward a Client Accounting and Advisory Services (CAAS) model and embrace the practice of Smart Client Management (SCM). With or without AI, you need to do both if you want your firm to thrive.

If anything, AI will force firms to look at how they can streamline operations, something they should be doing anyway. And it will spur them to find new ways to serve clients that are more consultative and less repetitive and seasonal. Again, your firm should be moving in that direction, anyway. AI can help you get there.

Accounting—and AI—work better in the cloud. Get started in the cloud today.